I don't pay any attention to Singapore currency simply because it is so tiny.

How convenient. However, that is actually a good argument, even if inadvertent, for a more decentralized city-state-type society.

I'm perfectly fine with paper money.

Singapore currency is a paper currency--the difference being it's backed by hard assets. I take it you mean that you're fine with fiat currency, correct?

It's the only viable alternative. Remember, for economy to function properly money has to be very liquid, compact, easily divisible into fractions, have relatively long shelf life, and have large enough supply. Paper money (as legal tender notes) is the only one that fits that requirement.

Again, the Singapore currency is paper legal tender notes, and it does all that.

Paper backed by precious metals has very limited supply not enough for economy to function properly especially in times of globalization.

As I have pointed out, precious metals are NOT the only way to back a currency so that it is a hard currency. The Singapore currency is not backed just by precious metals but also foreign assets from nations it trades with.

The goal of the Singapore monetary authority is "sustained non-inflationary economic growth" (

http://www.mas.gov.sg/). Singapore is one of the most globalized economies in the world. It's not without problems, but they seem to have figured out a decent way to create a hard currency in sophisticated economy. Here is an explanation of how the Singapore currency can grow to meet demand:

Ever Wondered How the Money Supply Grows in Singapore?

http://therichkidwannabe.blogspot.com/2011/01/ever-wondered-how-money-supply-grows-in.htmlInflation is not a problem. Economies grow the most when inflation is around 2-3%/year, anything outside of that range has negative effect on the economy.

There's no guarantee that inflation will remain forever within that narrow range, and it hasn't in the USA, historically, if you look beyond the last few decades:

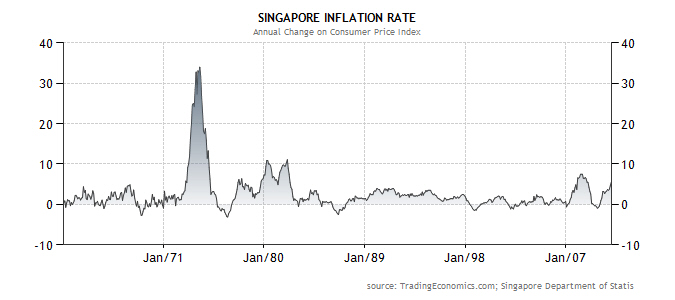

With a fiat currency, there is the potential for worse inflation and even catastrophic inflation and loss of confidence. As the chart shows, the shocks can also go the other way - to drastic deflation. Thus a fiat currency is less robust to unexpected shocks than a sophisticated modern hard currency. That's the point.

What has been the result of Singapore's pursuing a hard currency strategy (and sound fiscal policy)? "Singapore had a current account surplus of about 14 percent of GDP in 1995, the highest in the world, and much of this was used to acquire reserves (which stood at some $67 billion in September 1995, for less than 3 million people)...." (The Case for a Common Basket Peg for East Asian Currencies,

http://www.iie.com/publications/papers/paper.cfm?ResearchID=280).

The Singaporean inflation rate has remained relatively stable over the years despite Singapore being a fast-growing tiger economy. They did suffer an oil-price shock in the early 70s, as Singapore is even more dependent on foreign oil than the USA. Recent spiking in commodities and housing prices has caused the inflation rate to rise above the historical averages, but it still remains relatively controlled and along with the increase in inflation has gone an increase in the value of the hard assets that back it.

I don't know if the Singapore currency approach is exactly right for the USA, but it does appear to show that we are not without hope that there is a better way of doing things than our current fragile fiat currency approach. It seems like you're eliminating possibilities before you've even explored them, just so you can argue against Ron Paul.